A team led by Prof Steven KOU from the Department of Mathematics in NUS together with Dr NING Cai from the Hong Kong University of Science and Technology and Dr Yingda SONG from the University of Science and Technology of China demonstrated that the method proposed for pricing Asian options is accurate and fast under popular finance models.

Asian options, whose payoffs are contingent on the arithmetic average of the underlying asset prices over a pre-specified period, are among the most popular path-dependent options that are actively traded in the financial markets. The average of the underlying asset prices can be computed either discretely, for which the average is taken over the asset prices at discrete monitoring time points, or continuously, for which the average is calculated via the integration of asset prices over the monitoring time period. The valuation of Asian options is challenging since the arithmetic average usually does not have a simple distribution.

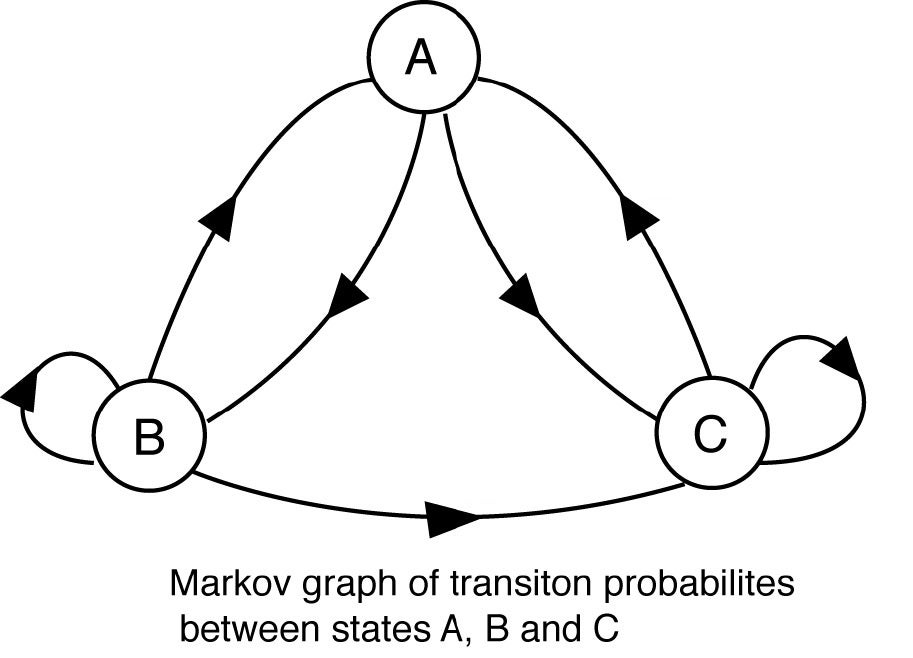

The existing literature mostly focuses on only one type of Asian option (discrete or continuous) and specific Markov processes, e.g. the geometric Brownian motion. However, this research paper provides a unified framework for pricing both discretely and continuously monitored Asian options under general one-dimensional Markov process models. A Markov process is a stochastic model that has the properties whose future state only depends on the current state, but not the past. Almost all models used in finance are Markov processes.

More precisely, the contribution of the paper is threefold. First, under general one-dimensional Markov processes, they derive the double transforms of the Asian option prices, either discretely or continuously monitored, in terms of the unique bounded solutions to related functional equations. Second, in the special case of continuous-time Markov chain (CTMC), they demonstrate that the functional equations reduce to linear systems that can be solved analytically via matrix inverses. Lastly, by constructing a CTMC to approximate the targeted Markov process first and then numerically inverting the double transforms related to the constructed CTMC, they show that the Asian option prices can be computed under general one dimensional Markov processes models.

Pricing Asian options under a CTMC is quite different from pricing other path-dependent options. For example, to price barrier options, one needs to first study passage times under a CTMC, which consists of analytical solutions in the form of a matrix, obtained by deleting some rows and columns in the transition rate matrix of the CTMC. Unfortunately, it is not easy to find such simple matrix operations for Asian options. This difficulty is overcome by working on the double transform of the continuously monitored (resp. discretely monitored) Asian option price with respect to the strike price and the maturity (resp. the number of monitoring time points). Then it can be shown that the double transforms are the unique bounded solutions to related functional equations, which can be solved analytically in the case of CTMCs, using the strictly diagonally dominant matrix and the Levy-Desplanques theorem.

Numerical results demonstrate that the method proposed in this paper is accurate and fast under popular Markov process models. The paper is published in the Operations Research in 2015.

Figure shows the Markov graph where it can be used to model a random system that changes states according to a transition rule that only depends on the current state. (A,B,C: States)

Reference

N Cai, Y Song, S Kou. “A General Framework For Pricing Asian Options Under Markov Processes.” Operations Research 63(3) (2015) 540.